Have you been on the fence about buying your home now or waiting to see if home prices come down? Perhaps, you have heard from people that the real estate market is going to crash because of the COVID-19 economic shut down. So, I would like to give you four reasons why it is different and why the impact in housing will not be as drastic as it was in the Great Recession.

- We need to know the problem originated in the housing sector during the Great Recession. There were some bad loans out there and financial institutions had to be bailed out. COVID-19 did not originate in the housing sector but in public health.

- Yes, the COVID-19 shutdown created a high unemployment rate at a very fast speed. However, according to the Becker Friedman Institute, University of Chicago, 68% of workers who are eligible to receiving unemployment qualify for more than what they would normally earn and 20% will receive two times more their regular earnings. This option was not available during the Great Recession.

- Under the CARES Act homeowners are able to apply for forbearance on their mortgage loan up to a year as well as apply for other options such as loan modifications before their house will be foreclosed on. During the Great Recession, by the time many homeowners had any of these options, their homes were already foreclosed. And since many of the servicers were not communicating between departments, when one department was approving a loan modification, the other one was concurrently foreclosing on the property. Also, most homeowners did not have equity in their home during the Great Recession; however, according to Black Knight Analytics the majority of people in forbearance right now have at least 20% equity.

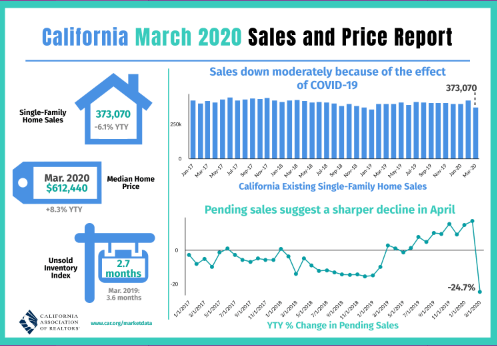

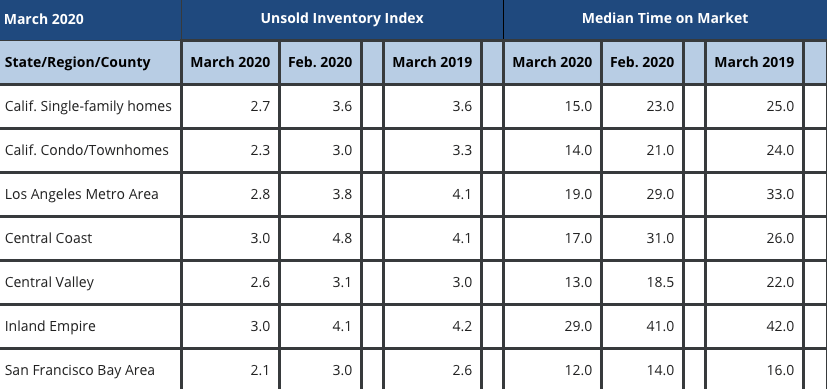

- There is a low inventory of homes for sale, which are not enough for the number of buyers looking to take advantage of the low interest rates. Sales slowed down a bit during the stay-at-home order mandate. However, they are starting to pick up with some hot spots selling homes within days. Interest rates will more likely be low until the end of the year according to the Federal Reserve.

As always, buying or selling depends on your individual needs and circumstances. Nonetheless, some additional information can be useful. If you have any questions on buying or selling your home, feel free to contact me.